Order Blocks

Order Blocks (OB) are crucial price zones where large

institutional traders like banks, hedge funds,

and smart money place significant buy or sell orders.

Order Blocks (OB)

Order Blocks (OB) are crucial price zones where large institutional traders like banks, hedge funds, and smart money place significant buy or sell orders. These zones act as strong support or resistance levels and often precede major price moves. Understanding Order Blocks helps traders align their trades with the market’s big players, improving accuracy and timing.

1. What is an Order Block?

An Order Block is a specific price area where big institutions have accumulated large buy or sell orders before a strong price move. It is typically identified as the last opposite candle before an impulsive move in price.

Bullish Order Block: Formed during a downtrend, it’s the last bearish candle before a strong upward move, indicating institutional buying interest. Acts as a support zone.

Bearish Order Block: Formed during an uptrend, it’s the last bullish candle before a strong downward move, indicating institutional selling pressure. Acts as a resistance zone.

Order Blocks reflect smart money activity and highlight where major players are likely to enter or exit the market.

2. Why Are Order Blocks Important?

They represent zones of high buying or selling interest by institutions.

Price often returns to these zones to fill unexecuted orders, creating potential reversal or continuation points.

Help traders identify precise entry and exit levels with better risk-reward.

Act as strong support or resistance due to the volume behind them.

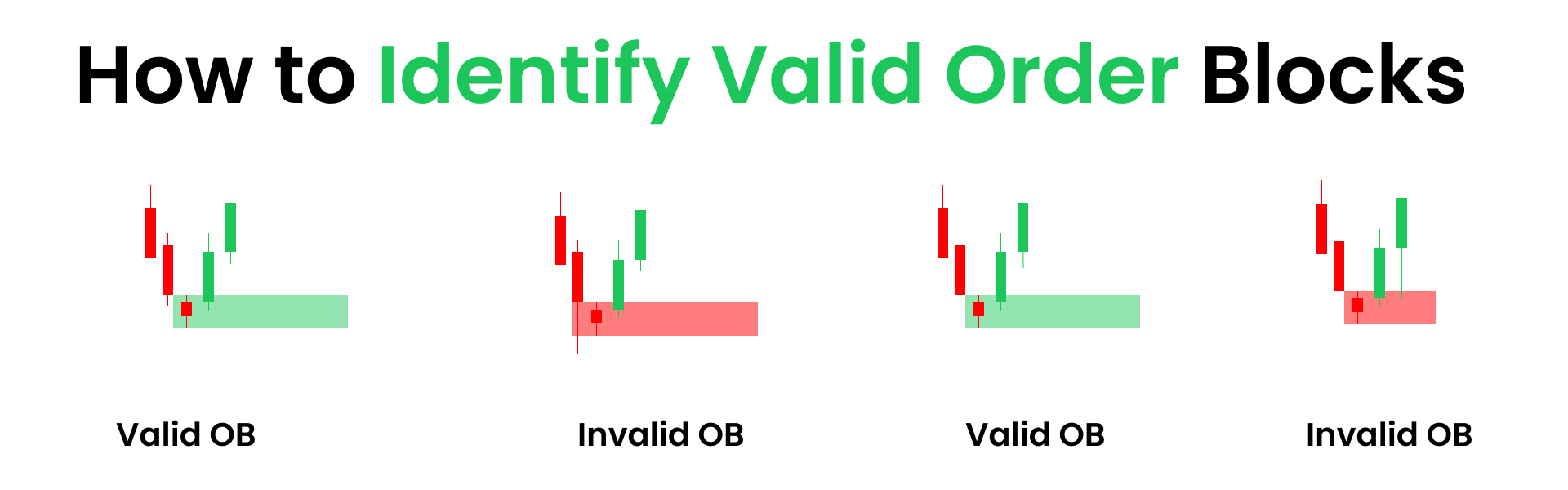

3. How to Identify Order Blocks?

Key Characteristics:

Formed before a strong impulsive price move (sharp candle or series of candles).

Usually appear after a consolidation or accumulation phase.

High volume often accompanies these zones.

Can be found on multiple timeframes but are most reliable on higher timeframes (daily, 4H).

Step-by-Step Identification:

Look for a consolidation or pause in price.

Identify the last opposite candle before a strong move (bullish move after bearish candle = bullish OB, bearish move after bullish candle = bearish OB).

Mark this candle’s high and low as the Order Block zone.

Watch for price to return to this zone for potential trade setups.

4. Order Blocks vs Supply and Demand Zones

Order Blocks are more precise and represent institutional order footprints.

Supply and Demand Zones are broader areas of buying/selling pressure based on general market activity.

Order Blocks focus more on smart money footprints and are often smaller, making them ideal for pinpoint entries.

5. How Do Order Blocks Work?

Institutions place large orders that cannot be filled all at once. After the initial impulsive move, price often retraces back to the Order Block zone to fill the remaining orders. This retracement provides traders with a high-probability entry point aligned with institutional activity.

6. Trading Strategies Using Order Blocks

| Strategy | Description | Entry/Exit Tips |

|---|---|---|

| Buy at Bullish Order Block | Enter long trades when price returns to a bullish OB zone. | Place stop loss below the OB zone; target next resistance. |

| Sell at Bearish Order Block | Enter short trades when price returns to a bearish OB zone. | Place stop loss above the OB zone; target next support. |

| Order Block Breakout | Trade the breakout when price decisively moves beyond OB. | Confirm with volume and price action before entry. |

| Confluence with Other Tools | Combine OB with volume, trend structure, or fair value gaps. | Improves trade accuracy and risk management. |

7. Practical Tips for Trading Order Blocks

Always wait for price confirmation (like a rejection candle or bullish/bearish engulfing) at the OB zone before entering.

Use higher timeframes to identify stronger order blocks.

Combine with multi-timeframe analysis for better context.

Manage risk by placing stop losses just outside the OB zone.

Avoid trading untested or mitigated order blocks (zones already filled or broken).

8. Common Mistakes to Avoid

Confusing order blocks with general support/resistance zones.

Trading without confirmation signals at the OB zone.

Ignoring market context and overall trend.

Using order blocks on very low timeframes without higher timeframe validation.

Conclusion

Mastering Order Blocks gives traders an edge by revealing where big players operate behind the scenes. By learning to identify, confirm, and trade these zones, you can improve your timing and accuracy in the markets. Practice spotting order blocks on historical charts, combine them with other smart money tools, and always use proper risk management for consistent results.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.