Liquidity and Liquidity Grabs

Follow the trading activities and ideas from your community members

Liquidity and Liquidity Grabs

Liquidity is a fundamental concept in trading and market structure analysis. It refers to how easily an asset can be bought or sold in the market without causing a significant change in its price. Understanding liquidity and liquidity grabs helps traders recognize where large players (institutions, market makers) operate, how price moves are manipulated, and where high-probability trade setups occur.

1. What is Liquidity in Trading?

Liquidity means the ability to quickly buy or sell an asset at a stable price without causing big price swings.

A liquid market has many buyers and sellers, making it easy to enter or exit trades.

An illiquid market has fewer participants, causing bigger price moves when trades happen.

Liquidity is measured by trade volume and the number of orders available at various price levels.

2. Types of Liquidity

Active Liquidity: Market orders that initiate price movement by consuming limit orders.

Passive Liquidity: Limit orders waiting to be filled, providing liquidity but not moving price.

Retail vs Institutional Liquidity: Both retail and institutional traders provide active and passive liquidity. Institutions often create large liquidity pools.

3. What Are Liquidity Grabs?

A Liquidity Grab (also called liquidity sweep or stop hunt) is a price move designed to trigger stop-loss orders clustered around obvious support or resistance levels.

Smart money or institutions push price beyond these levels to “grab” liquidity (stop orders), which provides them with the volume needed to enter or exit large positions without causing big slippage.

After liquidity is grabbed, price often reverses sharply in the opposite direction.

4. Why Do Liquidity Grabs Happen?

Large players need liquidity to execute big trades.

Stop losses and pending orders represent pools of liquidity.

By pushing price to these levels, institutions trigger these orders, creating the volume they need.

This process is part of market manipulation but also a natural part of price discovery.

5. How to Identify Liquidity and Liquidity Grabs on Charts

Look for obvious swing highs and lows where many stop-loss orders are likely placed.

Watch for sharp price spikes beyond these levels followed by quick reversals.

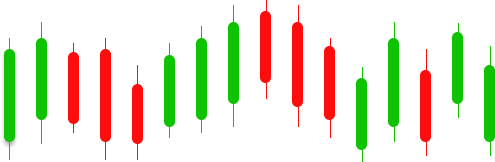

These spikes often leave wicked candles or false breakouts on the chart.

Liquidity grabs often occur near order blocks, fair value gaps, or key market structure levels.

6. Trading Strategies Using Liquidity and Liquidity Grabs

| Strategy | Description | Entry/Exit Tips |

|---|---|---|

| Trade the Reversal After Liquidity Grab | After a liquidity sweep, enter in the opposite direction when price shows rejection. | Wait for confirmation candle (e.g., pin bar) before entry. |

| Use Liquidity Pools as Targets | Identify liquidity zones and set profit targets near these areas. | Combine with market structure for better accuracy. |

| Avoid Trading During Liquidity Hunts | Recognize fake breakouts to avoid false entries. | Use higher timeframes and volume confirmation. |

| Combine with Order Blocks and FVGs | Use liquidity grabs near these zones for high-probability setups. | Align trades with smart money concepts. |

7. Importance of Liquidity in Market Structure

Liquidity ensures smooth price movement and trade execution.

Price tends to move toward areas of high liquidity (liquidity pools) because these zones offer easier trade execution.

Market makers and institutions provide liquidity but can also remove it to manipulate price.

Understanding liquidity helps traders avoid traps and find smart money footprints.

8. Practical Tips for Traders

Always identify key support and resistance levels where liquidity pools form.

Be cautious of sharp spikes beyond these levels—these may be liquidity grabs.

Use multiple timeframes to confirm liquidity zones and grabs.

Combine liquidity analysis with other smart money tools like order blocks and fair value gaps.

Manage risk by placing stops outside liquidity zones to avoid being stopped out prematurely.

Conclusion

Mastering liquidity and liquidity grabs gives traders insight into how large players operate behind the scenes. By learning to identify liquidity pools, anticipate liquidity sweeps, and trade reversals effectively, you can improve your trading precision and avoid common traps. Practice spotting these concepts on historical charts and integrate them with your overall market structure analysis for consistent trading success.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.