-

By UP Forex Academy

By UP Forex Academy - 03/07/2025

- 0 Comments

- Live trade

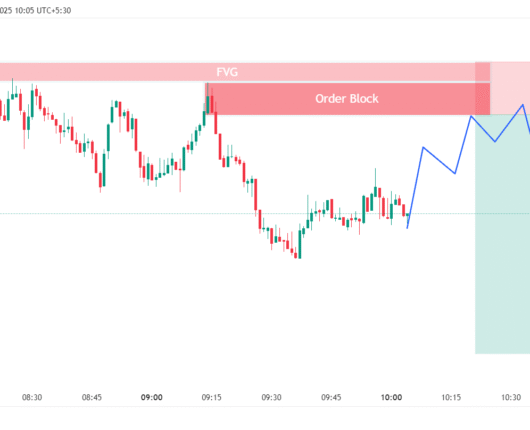

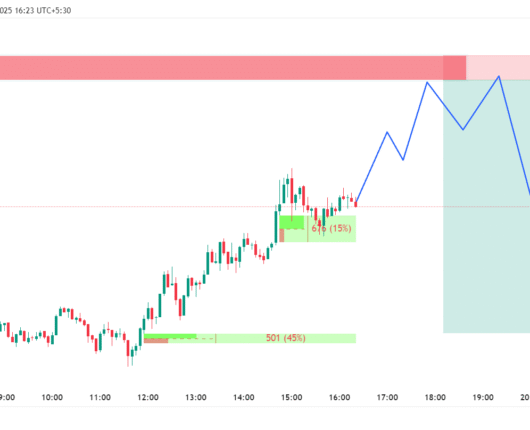

Planning a trade on XAU/AUD requires a disciplined approach, especially when using price action strategies. Here’s a step-by-step trade plan based on the current market structure:

Trade Overview

- Instrument: XAU/AUD (Gold vs Australian Dollar)

- Date: July 3, 2025

- Chart Analysis: The market shows a recent bullish move, followed by a pullback, and is now consolidating near a key support level.

Entry, Stop Loss, and Target

- Entry Point: Around 3,354.38 (current market price as per chart).

- Stop Loss: Slightly below the recent swing low, near 3,351.00. This protects you if the price breaks below the support zone.

- Take Profit: Targeting the upper resistance zone, around 3,367.50, which offers a favorable risk-reward ratio.

Trade Rationale

- Price Action: The recent bullish momentum and higher lows suggest buyers are in control. The current consolidation near support indicates a potential continuation to the upside if the level holds.

- Risk Management: Position size should be calculated based on your account size and risk tolerance, ensuring you do not risk more than 1-2% of your capital per trade.

- Confirmation: Wait for a bullish candlestick pattern or a strong rejection from the support zone before entering the trade for added confirmation.

Additional Tips

- Monitor economic news from Australia and global gold markets, as volatility can impact XAU/AUD.

- Keep a trading journal to record your entry, exit, emotions, and trade outcome for continuous improvement.

By following this structured plan, you can approach the XAU/AUD trade with confidence and discipline, increasing your chances of consistent returns.

Disclaimer

I am not a SEBI-registered or any other officially registered financial advisor. The information and analysis provided here are for educational and informational purposes only. Please do your own research and consult with a registered financial advisor before making any trading or investment decisions.