-

By UP Forex Academy

By UP Forex Academy - 10/07/2025

- 0 Comments

- Live trade

US30 Intraday Trade Setup – July 10, 2025

Trade Setup Table

| Parameter | Details |

|---|---|

| Instrument | US30 (Dow Jones Index) |

| Timeframe | Intraday |

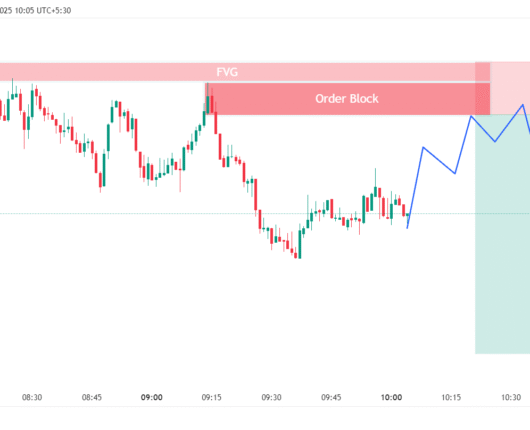

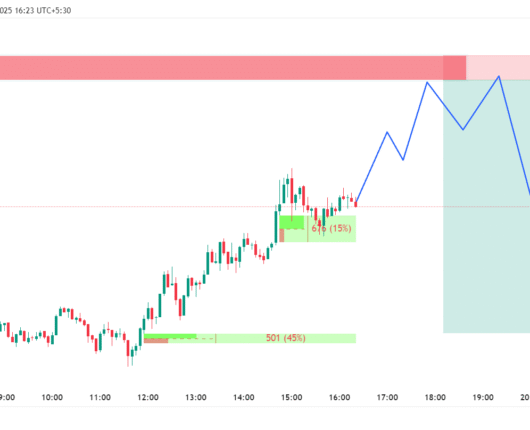

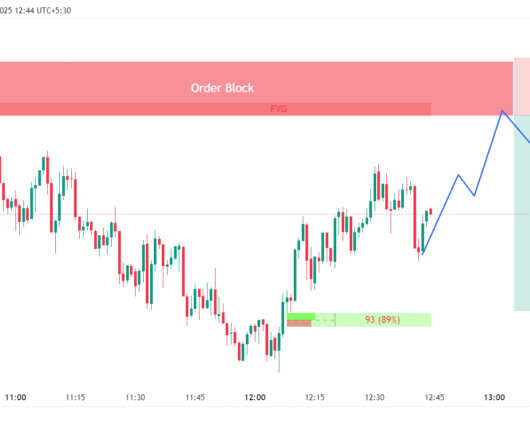

| Strategy | Order Block & Smart Money Concepts |

| Order Block Zone | 44,342.1 – 44,355.3 |

| Entry | 44,342.1 (after price reacts to OB zone) |

| Stop Loss | 44,355.3 (above order block) |

| Target | 44,284.2 (previous liquidity zone) |

| Risk/Reward | Favorable (tight SL, clear target) |

Trade Rationale

Order Block: Price retraced to a key bearish order block, indicating potential institutional selling pressure.

Confirmation: Wait for bearish price action within the order block before entering.

Risk Management: Tight stop loss above the order block for optimal protection.

Target: Previous liquidity zone, ensuring a solid risk-reward profile.

Trading Plan

Enter short near 44,342.1 after bearish confirmation in the order block.

Place stop loss at 44,355.3 to minimize risk.

Target 44,284.2 for profit booking.

Stick to your plan and review your journal post-trade for continuous improvement.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.