Liquidity and Liquidity Grabs

Follow the trading activities and ideas from your community members

Breaker Blocks Complete Easy to Understand

Breaker Blocks are an advanced and powerful concept within Smart Money Concepts (SMC) trading. They represent key price zones where the market structure shifts, often signaling trend reversals or continuations driven by institutional traders. Mastering breaker blocks helps traders anticipate where smart money is acting and position themselves accordingly for higher-probability trades.

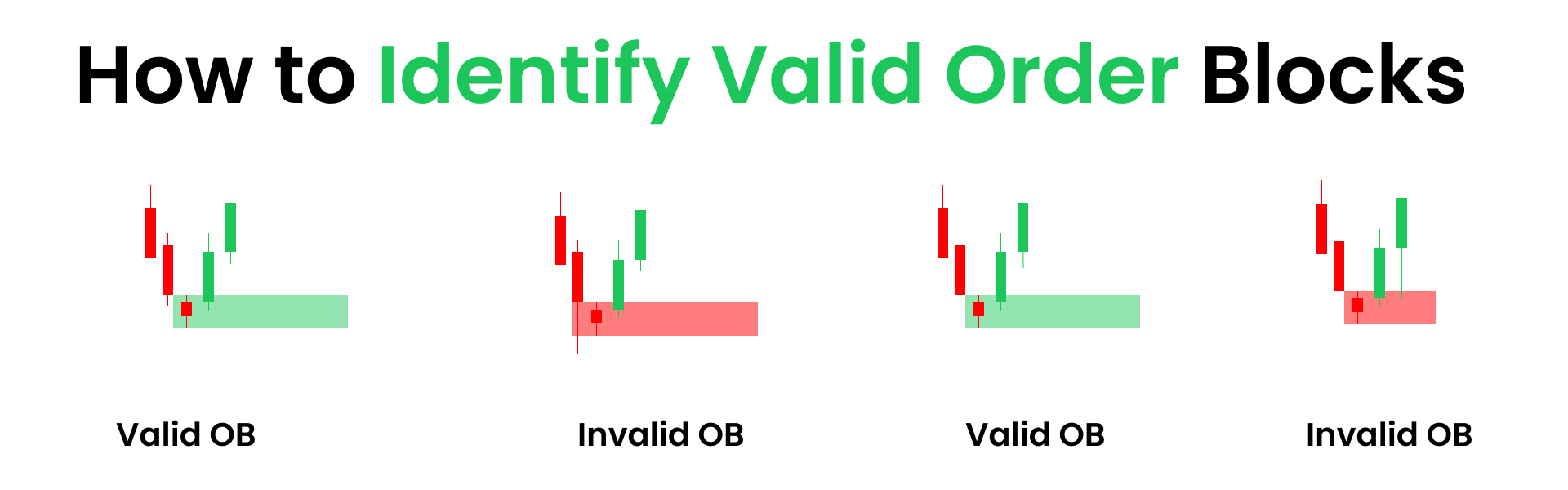

1. What Is a Breaker Block?

A Breaker Block is essentially a failed order block that forms after a significant break in market structure. When price breaks through a previous support or resistance level (order block) and invalidates it, that zone transforms into a breaker block. This zone then acts as a new level of support or resistance, often causing price to retest it before continuing the new trend.

Bullish Breaker Block: Formed when a bearish order block is invalidated by price breaking above it, turning the zone into a new support.

Bearish Breaker Block: Formed when a bullish order block is invalidated by price breaking below it, turning the zone into a new resistance.

Breaker blocks indicate a shift in market momentum and reveal where institutional traders have engineered liquidity hunts to trap retail traders before pushing price in the new direction.

2. How Do Breaker Blocks Form?

The market breaks a key structure level support or resistance.

The original order block where institutions accumulated orders fails to hold.

Price retraces to retest the failed order block zone, which now acts as a breaker block.

This retest provides an opportunity to enter trades aligned with the new market structure.

3. Why Are Breaker Blocks Important?

Market Structure ShiftThey mark the transition from bullish to bearish trends or the other way around.

Liquidity Zones: Breaker blocks often coincide with liquidity pools created by stop-loss orders, which smart money targets.

Trade Entry Zones: Provide high-probability areas for entering trades after confirmation.

Support/Resistance Flip: This happens when a previous support level turns into resistance, or a previous resistance becomes support, often influenced by big institutional traders rather than just regular market moves

4. How to Identify Breaker Blocks

| Step | Description |

|---|---|

| Identify Order Block | Find a bullish or bearish order block where institutions placed large orders. |

| Spot Market Structure Break | Price breaks above a bearish order block or below a bullish order block, invalidating it. |

| Mark the Breaker Block | The invalidated order block zone becomes the breaker block (new support or resistance). |

| Wait for Retest | Price often returns to retest this breaker block before continuing the trend. |

5. Trading Strategies Using Breaker Blocks

Entry: Enter trades when price retraces to the breaker block zone and shows confirmation (e.g., reversal candlestick, volume spike).

Stop Loss: Place stop loss just beyond the breaker block zone to protect against false breakouts.

Take Profit: Target the next key liquidity zone, order block, or significant support/resistance level.

Confirmation: Combine with other Smart Money Concepts like Fair Value Gaps (FVG), Break of Structure (BOS), and Change of Character (ChoCH) for higher accuracy.

6. Breaker Blocks vs. Order Blocks

| Feature | Order Block | Breaker Block |

|---|---|---|

| Definition | Zone where institutions accumulate orders before a big move | Failed order block that becomes a new support/resistance after structure break |

| Market Role | Accumulation/distribution zone | Zone indicating market structure shift |

| Formation | Before a strong price move | After price breaks and invalidates an order block |

| Trading Use | Entry zones for initial institutional orders | Entry zones for retests and trend continuation/reversal |

7. Examples of Breaker Blocks in Action

Price breaks below a bullish order block (support), invalidating it, then returns to retest this zone as a bearish breaker block (resistance) before continuing downward.

Price breaks above a bearish order block (resistance), invalidating it, then retests this zone as a bullish breaker block (support) before moving higher.

8. Tips for Trading Breaker Blocks

Use higher timeframes (4H, Daily) for more reliable breaker block identification.

Wait for retest and confirmation signals before entering trades.

Combine breaker blocks with other SMC tools for confluence.

Always apply strict risk management with stop losses and position sizing.

Quick Reference Table

| Aspect | Details |

|---|---|

| Definition | Failed order block turned into new support/resistance after market structure break |

| Bullish Breaker Block | Formed when bearish order block is invalidated by price breaking above |

| Bearish Breaker Block | Formed when bullish order block is invalidated by price breaking below |

| Formation Trigger | Market breaks previous support/resistance (order block) |

| Trading Signal | Price retests breaker block zone + confirmation |

| Stop Loss Placement | Just beyond breaker block zone |

| Timeframes | All timeframes; higher timeframes preferred |

| Markets | Forex, stocks, crypto, commodities, indices |

9. Summary

Breaker Blocks are failed order blocks that signal a shift in market structure and momentum. They act as flipped support/resistance zones and provide strategic trade entry points after price retests them. Incorporating breaker blocks into your trading toolkit enhances your ability to follow institutional smart money and improve trade accuracy.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.