Liquidity and Liquidity Grabs

Follow the trading activities and ideas from your community members

Fair Value Gaps (FVG)

A Fair Value Gap (FVG) is a price range on a chart where there is an imbalance between buyers and sellers, created by a sudden and strong price movement. This gap leaves a “void” or untraded area on the chart, representing inefficiency in the market. Because markets tend to seek balance, prices often return to fill these gaps before continuing their trend.

1. What is a Fair Value Gap?

A Fair Value Gap occurs when there is a noticeable gap between the closing price of one candle and the opening price of the next, with little or no trading in between.

It usually forms after a rapid price move caused by strong buying or selling pressure, leaving an imbalance.

This gap is a sign that the market has not fully “digested” the price move, and price often retraces to fill this gap later.

2. Why Do Fair Value Gaps Form?

Fair Value Gaps typically form due to:

High Market Volatility: Sudden buying or selling pressure causes rapid price changes.

News and Economic Events: Important announcements like interest rate changes or earnings reports trigger sharp moves.

Institutional Trading: Large orders from banks or hedge funds create quick price jumps, leaving gaps behind.

3. How to Identify Fair Value Gaps on a Chart

Look for a three-candle pattern where the middle candle creates a gap between the high of the first candle and the low of the third candle (for bullish FVG), or vice versa for bearish FVG.

The gap area is the price range between these candles where little or no trading occurred.

On candlestick charts, this appears as a visible empty space or imbalance zone.

4. Types of Fair Value Gaps

Bullish Fair Value Gap: Occurs when price rapidly moves up, leaving a gap below the current price. Price often returns to this gap to find support before continuing upward.

Bearish Fair Value Gap: Occurs when price rapidly moves down, leaving a gap above the current price. Price often returns to this gap to find resistance before continuing downward.

5. Why Are Fair Value Gaps Important for Traders?

They highlight areas of market imbalance where price is likely to revisit.

Provide precise entry points for trades aligned with the overall trend.

Help traders anticipate retracements or corrections before trend continuation.

Offer natural zones for placing stop-loss orders to manage risk.

6. Fair Value Gap Trading Strategy – Step-by-Step

| Step | Description |

|---|---|

| Identify the FVG | Spot the gap between candles on your chart after a strong price move. |

| Wait for Price Retracement | Observe if price returns to fill the gap area, signaling a potential trade setup. |

| Confirm with Price Action | Look for reversal signals like pin bars, engulfing candles, or volume spikes near the gap. |

| Enter the Trade | Buy near bullish FVG or sell near bearish FVG, aligned with the main trend direction. |

| Set Stop Loss | Place stop loss just outside the FVG zone to limit risk. |

| Target Profit | Aim for the next support/resistance or use trailing stops to maximize gains. |

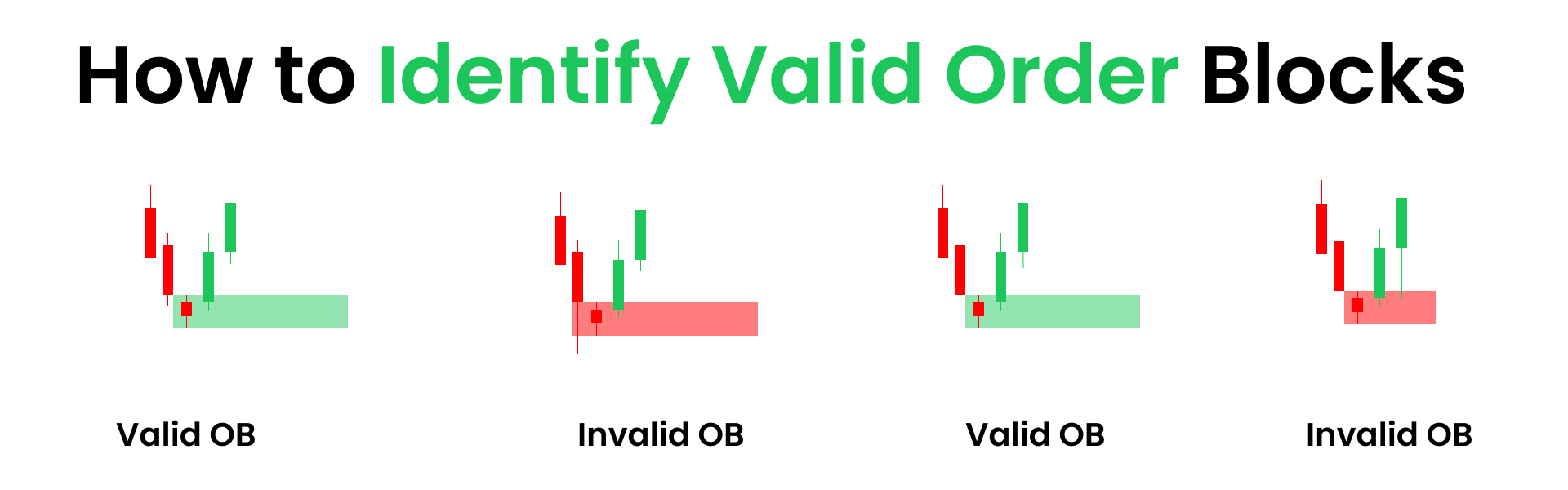

7. Combining Fair Value Gaps with Market Structure

Use FVGs along with Break of Structure (BoS) and Change of Character (CHoCH) to confirm trend direction and reversals.

FVGs often form near order blocks or liquidity zones, increasing the probability of a strong reaction.

Multi-timeframe analysis helps validate FVGs on higher timeframes for stronger signals.

8. Pros and Cons of Fair Value Gap Trading

| Pros | Cons |

|---|---|

| Provides clear and precise trade entries | Not all FVGs get filled, leading to false signals |

| Highlights market imbalances effectively | Waiting for price to fill the gap can take time |

| Supports trend-following strategies | Requires patience and discipline |

| Helps with risk management using stop loss | Manual identification can be complex initially |

Conclusion

Mastering Fair Value Gaps allows traders to spot market inefficiencies and anticipate price retracements with precision. By learning to identify, confirm, and trade FVGs alongside other market structure tools, you can significantly improve your trading performance. Practice spotting FVGs on historical charts and integrate them into your trading plan with disciplined risk management for best results.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.