Liquidity and Liquidity Grabs

Follow the trading activities and ideas from your community members

Market Structure (Market Trend Analysis)

Introduction to Market Structure

Market structure is a framework that helps you understand the direction in which the market price is moving. It maps out past highs and lows of price action, enabling traders to predict future price movements. Understanding market structure is crucial for identifying trends, finding entry and exit points, and managing risk effectively.

1. What is Market Structure?

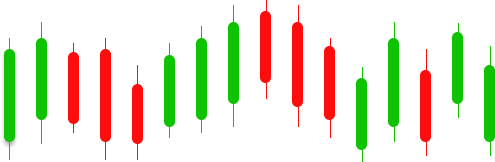

Market structure is the visual representation of price swings—highs and lows—that form a pattern over time. Unlike real-time price action, market structure is a fixed pattern that shows where price has reversed or paused, highlighting key support and resistance zones.

2. Basic Components of Market Structure

Higher Highs (HH) and Higher Lows (HL): In an uptrend, price creates new highs and lows that are higher than the previous ones.

Lower Highs (LH) and Lower Lows (LL): In a downtrend, price forms new highs and lows that are lower than the previous ones.

These swings define the overall trend direction.

3. Identifying Trends

Uptrend: A sequence of Higher Highs and Higher Lows, indicating bullish momentum.

Downtrend: A sequence of Lower Highs and Lower Lows, indicating bearish momentum.

Sideways/Range: When price fails to make clear HH/HL or LH/LL, indicating consolidation.

4. Break of Structure (BoS)

A Break of Structure occurs when price breaks a previous swing high or low, signaling a potential trend change. For example, if price in an uptrend makes a Lower Low, it indicates a break of structure and possible trend reversal or pullback.

5. Change of Character (CHoCH)

Change of Character is a shift in market behavior from bullish to bearish or vice versa. It often follows a Break of Structure and signals a strong trend reversal.

6. Multi-Timeframe Market Structure

Market structure exists on all timeframes, from minutes to months. Analyzing multiple timeframes helps traders align with the bigger trend and find better entry points on lower timeframes. This fractal nature means patterns repeat across timeframes.

7. Impulsive Moves and Pullbacks

Impulsive Move: A strong, directional price move, such as a large bullish candle in an uptrend.

Pullback: A temporary reversal or retracement after an impulsive move, often used by traders to enter the trend at a better price.

8. Practical Trading Using Market Structure

Trade in the direction of the trend (buy in uptrend, sell in downtrend).

Use Break of Structure and Change of Character to identify trend reversals or continuations.

Enter trades on pullbacks for better risk-reward.

Place stop losses beyond recent swing highs or lows.

Confirm trades with multi-timeframe analysis for higher accuracy.

Conclusion

Mastering Market Structure is key to successful trading. It clearly shows market direction and helps you choose optimal entry and exit points. This course covers everything from basic trend identification to advanced concepts like Break of Structure and Change of Character, along with multi-timeframe analysis. Practicing these concepts will elevate your trading skills to the next level.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.