Break of Structure

Break of Structure (BoS) and Change of Character

(CHoCH) are two of the most powerful concepts in market structure analysis.

Break of Structure (BoS) and Change of Character (CHoCH)

Break of Structure (BoS) and Change of Character (CHoCH) are two of the most powerful concepts in market structure analysis. Mastering these helps traders spot trend continuations, reversals, and high-probability trade setups. This course explains both concepts in simple, actionable language for beginners and experienced traders.

1. What is Break of Structure (BoS)?

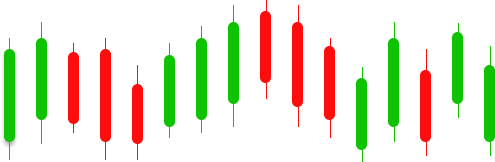

A Break of Structure (BoS) occurs when price decisively moves beyond a previous swing high (in an uptrend) or swing low (in a downtrend), breaking a significant support or resistance level. This signals a potential trend continuation or shift in market sentiment.

Types of BoS

Bullish BoS: Price breaks above a previous resistance or swing high, indicating buyers are in control and the uptrend may continue.

Bearish BoS: Price breaks below a previous support or swing low, indicating sellers are in control and the downtrend may continue.

False BoS: Sometimes price briefly breaks a level but quickly reverses. This is a false breakout and requires confirmation before trading.

Why BoS Matters

Confirms trend direction (continuation or reversal)

Provides clear entry and exit signals

Helps identify market momentum and sentiment

2. What is Change of Character (CHoCH)?

Change of Character (CHoCH) signals a shift in market structure from bullish to bearish or vice versa. It usually occurs after a BoS and marks the first sign of a potential trend reversal.

How CHoCH Works

In an uptrend: Price forms higher highs and higher lows. When price breaks below a previous higher low (support), it signals CHoCH—bulls are losing control, and a downtrend may start.

In a downtrend: Price forms lower lows and lower highs. When price breaks above a previous lower high (resistance), it signals CHoCH—bears are losing control, and an uptrend may begin.

Why CHoCH Matters

Early warning of trend reversal

Helps traders exit or reverse positions before a major move

3. How to Identify BoS and CHoCH (Step-by-Step)

A. Identifying BoS

Mark recent swing highs and swing lows on your chart.

Watch for price to close decisively above (bullish) or below (bearish) these levels.

Confirm with volume or other price action signals for reliability.

B. Identifying CHoCH

After a BoS, look for price to break the most recent opposite swing (e.g., break a higher low after an uptrend).

This break signals a shift in control from buyers to sellers or vice versa.

4. Trading Strategies Using BoS and CHoCH

| Scenario | Signal | Action | Example Entry/Exit |

|---|---|---|---|

| Uptrend, Bullish BoS | New high breaks | Enter long on retest | Buy after price retests broken high |

| Downtrend, Bearish BoS | New low breaks | Enter short on retest | Sell after price retests broken low |

| Uptrend, Bearish CHoCH | Breaks higher low | Exit long / consider short | Close buys, look for sell confirmation |

| Downtrend, Bullish CHoCH | Breaks lower high | Exit short / consider long | Close sells, look for buy confirmation |

5. Practical Tips for BoS & CHoCH Trading

Use Multiple Timeframes: Confirm BoS and CHoCH on higher timeframes for stronger signals.

Wait for Candle Close: Avoid false signals by waiting for a solid candle close beyond the key level.

Combine with Other Tools: Use volume, order blocks, or fair value gaps for extra confirmation.

Risk Management: Always use stop-loss orders beyond the most recent swing to protect capital.

Conclusion

Understanding BoS and CHoCH empowers traders to read market structure like professionals. These concepts provide clear, actionable signals for trend continuation and reversal, making them indispensable for anyone serious about trading success. Practice identifying BoS and CHoCH on historical charts to gain confidence and refine your trading strategy.

Disclaimer

I am not registered with SEBI or any other regulatory authority. The content and strategies shared on UP Forex Academy site are for educational and informational purposes only. Trading involves significant risk, and you should consult with a licensed financial advisor before making any investment decisions.